Apple’s Mac business was still growing in the U.S. in Q2, but not at the same scale as other PC vendors, with analysts reporting a small rise in shipments compared to its rivals.

Apple has enjoyed growth of its Mac business when looking at the overall global market. However, when it comes to the United States, Apple’s fortunes are much more muted.

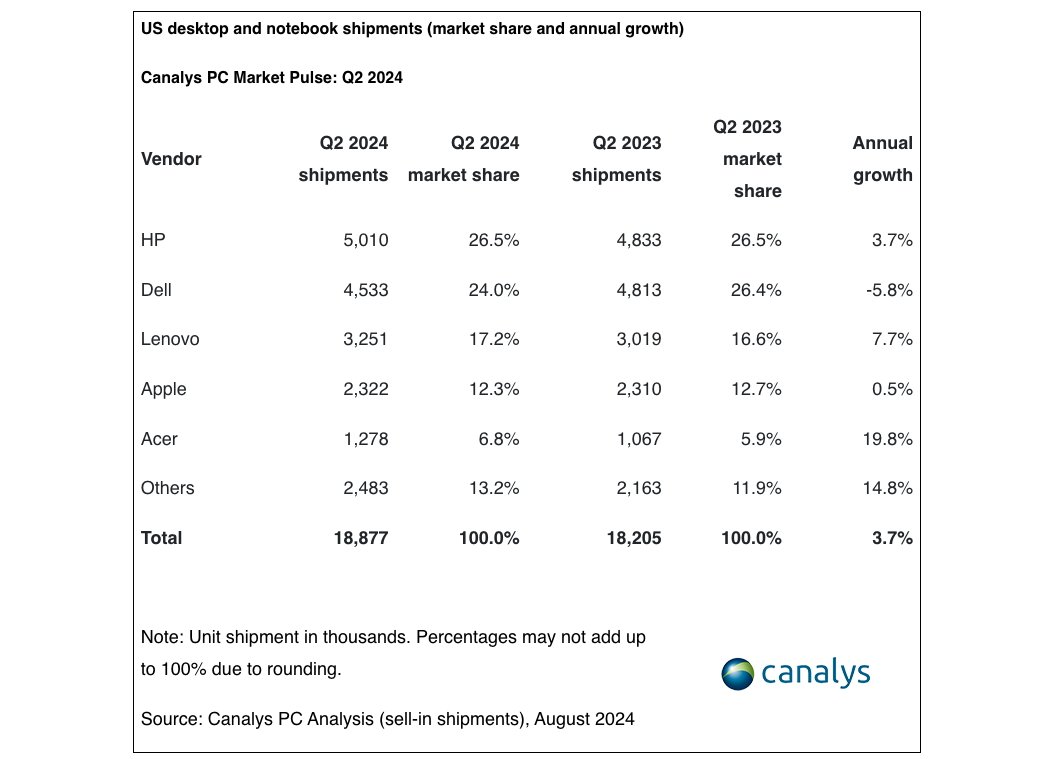

According to Canalys analysis of Q2 PC and notebook shipments in Q2 2024, Apple managed approximately 2.32 million Mac shipments. This is a small improvement compared to the 2.31 million shipments of Q2 2023, representing a year-on-year growth of just 0.5%.

As a whole, the number of shipments in the U.S. market totaled over 18.8 million shipments for Q2 2024, with a year-on-year growth of 3.7%.

With the market seeing annual growth at a far higher rate than the relatively flat Apple growth, this means Apple’s market share shrank as well.

For Q2 2024, it had a 12.3% market share, making it the fourth-largest PC vendor for the quarter. However, in Q2 2023, it had a larger 12.7% market share.

On a global level, Apple saw 6% year-on-year shipment growth to 5.51 million units in Q2 2024, and an increase in market share to 8.8%.

Canalys doesn’t offer any explanation for why Apple’s sales are flat, but it is probably due to consumers awaiting new updates. Apple last updated its MacBook Pro in November alongside an iMac refresh, while 2024’s release slate has solely consisted of the MacBook Air refresh.

With the introduction of the new iPad Pro in May, potential upgraders may be holding off until Apple brings out M4 Mac models. Current speculation is for that to occur in October.

The U.S. market continues to be led by HP, with 5.01 million shipments equating to 3.7% annual growth and a 26.5% market share for Q2 2024. Dell followed with 4.53 million units, an annual decline of 5.8% but maintaining a 24% market share.

In third, above Apple, is Lenovo with 3.25 million shipments, 7.7% growth, and a 17.2% market share.

On an annual basis, the U.S. market is expected to see 69.69 million shipments in 2024, up 6% from 65.78 million for 2023. For 2025, total market shipments are expected to grow another 6.2%, reaching 73.98 million in the year.

Canalys also adds that consumer shipments have also remained relatively stagnant in 2024 in general. Based on segment, U.S. shipments to consumers in 2024 is anticipated to grow by just 0.6%.

Shipments to commercial customers is anticipated to rise 8.5% in 2024, with government shipments growing 12.9% and education shipments up 10%.

Consumer shipments should bounce back in 2025, the analysts reckon, with a 6% growth spurt forecast.