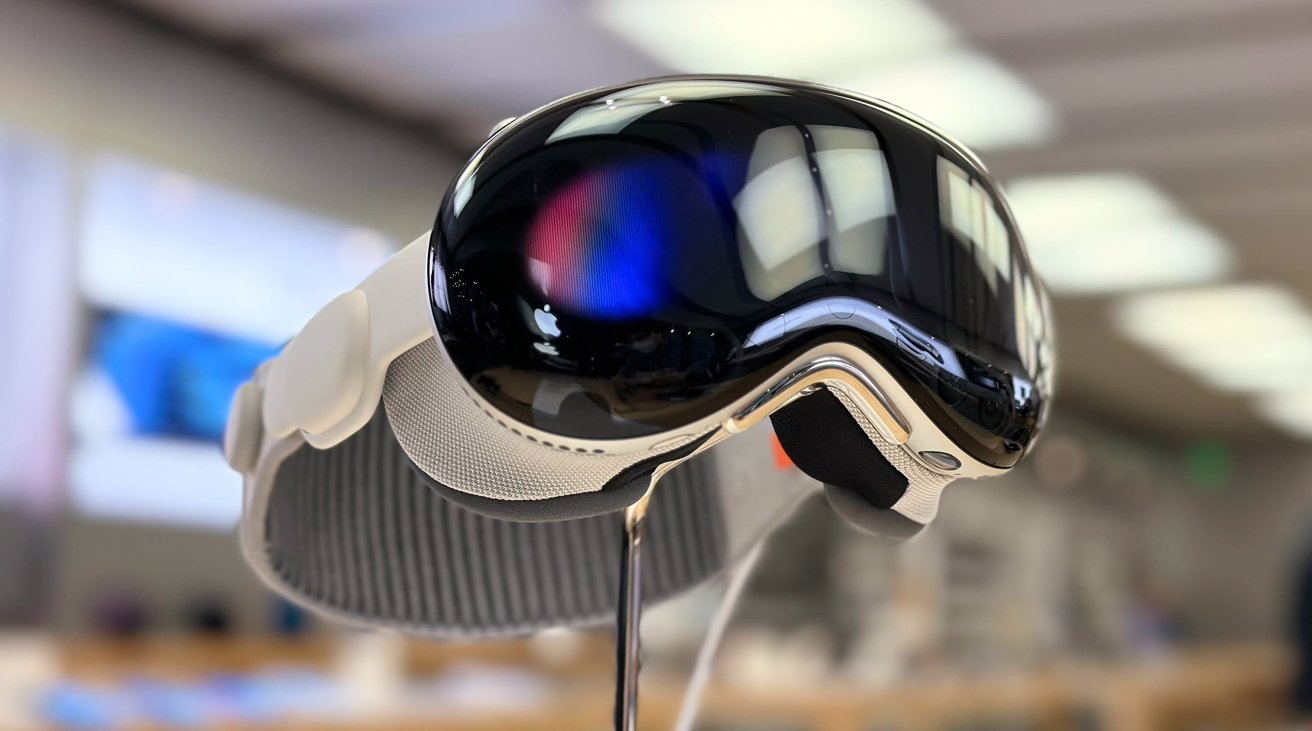

Wowed by their experience with Apple Vision Pro, analysts at Morgan Stanley see “immense” long-term potential for the Spatial Computing headset that Wall Street has yet to fully appreciate.

After the first weekend of availability, the Apple Vision Pro has received considerable interest from early adopters and industry observers. In a note to investors seen by AppleInsider, analysts at Morgan Stanley are bullish about the headset’s potential.

After three days of Apple Vision Pro ownership, the analysts have been immersed in Apple’s Spatial Computing paradigm. “We’ve been impressed by our experience with the device thus far,” the writers of Tuesday’s note admit.

Content consumption will be the initial “killer app” for consumers, with immersive video, mixed-reality gaming, and live sports the probable leaders in that field. The clarity and sharpness of two displays exceeding 4K in resolution is “incredible” and makes it a “entirely new way of consuming content.”

As such, the Apple Vision Pro is “clearly constructed to become a content powerhouse.” And, the analysts see it as a “free call option on the future of spatial computing.”

Apple Vision Pro: Productivity potential

The potential for the Apple Vision Pro is immense when it comes to the world of work. The visionOS movable windows have the same effect as using multiple real-world displays on a Mac, and the same multi-tasking potential.

“While we believe an external/Bluetooth keyboard is necessary to actually use the Vision Pro for productivity purposes, we can see the potential here, but it’ll take some getting used to,” the note adds.

Indeed, it is apparently “ripe for enterprise adoption,” with the best experiences made using short-form experiences under 30 minutes, within a mixed-reality setting. This is thought as the Apple Vision Pro’s enterprise use cases to potentially include virtual simulations, digital showrooms, remote training, virtual marketing, and “in-field remote break/fix.”

By adding 5G connectivity, the use cases could improve, but even now the Vision Pro “has real potential to disrupt the enterprise despite being primarily marketed as a consumer device. “

“We believe the enterprise opportunity could become much larger than is currently expected,” the analysts insist.

More plusses, some minuses

The praise for the headset extended to many areas, including the in-store experience that is “unlike any other Apple product” as a “very high-touch experience.” The in-store demo was “extremely useful in learning how to control the headset ahead of bringing it home.”

The eye-tracking and external cameras were also more accurate and responsive than expected, “and frankly easy to use.” While the controls did take some getting used to, it “becomes quite intuitive in short order.”

While heaping praise for the most part, Morgan Stanley did have some areas of improvement for Apple to consider. The top one being the feeling of “strapping a computer to your face will take getting used to.” The weight makes it “moderately uncomfortable” when used beyond 30 minutes, though you “tend to forget about the feel” when immersed in 3D videos.

The lack of shareability is also a problem, despite the existence of a Guest User. The problem is more that users have to go through various tests to fit the device.

“They have to do the same fitting process each time a new user wears the Vision Pro,” the note laments. “This means that unlike sharing an iPhone, iPad, MacBook etc., the Vision Pro is a device made just for the primary purchaser.”

Further complaints are made about the native App ecosystem being a little anemic in its early days, as well as video pixelation around the periphery. “It’s not evident enough to take away from the overall use experience, but it’s an area where we see room for improvement in the Gen 2 device,” they wrote.

Cost is always a factor

The last problem is one of expense, with the $3,500 hardware still “price prohibitive.” To Morgan Stanley, “The Vision Pro will remain niche until Apple introduces more form factors and lower price points.”

Surveys show that lower price points would have “a material impact on purchasing intentions,” with half of U.S. iPhone owners happy to spend an average of $1,000 on a lower-priced model.

“Chinese iPhone owners are even more bulled up, and willing to spend nearly 2x what US iPhone owners would pay,” the note from Morgan Stanley says.

Morgan Stanley currently forecasts that Apple’s headset business will “conservatively” ramp up to $4 billion per year in revenue after four years. In theory, this would be below the product ramps of the Apple Watch and AirPods in their post-launch timings.

Summing up, Morgan Staley feels “the long-term potential of the Vision Pro is immense, and against low investor expectations, the success of this device and its future successors is effectively a free call option on Apple innovation, suggesting the Vision Pro has the potential to surprise to the upside over the next 3-5 years.”

Morgan Stanley rates Apple’s stock as “Overweight” with a price target of $220. This is unchanged from their previous guidance on the stock.